who claims child on taxes with 50/50 custody texas

Who Claims the Child With 5050 Parenting Time. The parent with the highest adjusted gross income if the child lives equal amounts of time with each parent.

50 50 Custody Arrangement In Texas Maynard Law Firm Pllc

I never really had interest in them but kept them.

. Parents can also come to a mutual agreement regarding which of them will claim the child when filing for taxes. If you and the other parent split possession time equally you can take advantage of the IRSs tiebreaker rule. But there is no option on tax forms for 5050 or joint custody.

The skilled Texas custody attorneys at The Larson Law Office have fought for parents like you in their quest for equal custody of their children. Generally IRS rules state that a child is the qualifying child of the custodial parent and. The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household.

Call 713 221-9088 or contact us online today for a free consultation. The parent with whom the child lived the longest - sometimes a nominal 5050 custody arrangement for educational purposes has the child staying with one parent marginally longer over the course of the year. Therefore the following questions and answers may help determine who can file their dependent child on their taxes in a 5050 agreement.

In cases where custody is. When claiming your child as dependents on tax returns make sure that the child meets the qualifying child requirements. If parents truly did spend an equal number of days with the kids possible in a leap year or when the child spends time with a third party the parent with the highest adjusted gross income AGI can claim the child.

In 2006 my old room mate who I also dated on and off gave me a collection of coins that he inherited from his grandmother. The largest child care tax credit a parent can claim is 600. Who claims child on taxes with a 5050 custody split.

If YES you are a custodial parent so you may file the dependents on your taxes. If NO you are not a custodial parent. You need an experienced advocate to help you fight for your right to be with your children.

The IRS developed a tiebreaker rule to help divorced. Who Claims a Child on Taxes With 5050 Custody. No only one custodial parent can claim a child as a dependent on their tax returns.

1 Have I spent more than 183 days with my children in the past year. Who Can Claim Children on Taxes in a 5050 Custody Order. It is their choice to do so.

The custodial parent can transfer the exemption to the non-custodial parent by providing them with a signed copy of Form 8332. Equal The parent who qualifies as the custodial parent under federal tax law is the one who claims the children as dependents. Typically when parents share 5050 custody they alternate between odd and even.

FAQs About Tax Deductions With Joint or 5050 Custody Can both parents claim a child on taxes. Who claims child on taxes with 5050 custody texas. If there is more than one child the court may divide the children between the parents for tax purposes somewhat simplifying the process.

If parents have 5050 parenting time but one parent contributes significantly more financials that parent may get to claim the child ren a greater percentage for example 2 out of 3 years. Generally IRS rules state that a child is the qualifying child of the custodial parent and. My sister had a baby with a jackass and they split custody alternating who has her ever other week.

Who Claims a Child on Taxes With 5050 Custody. The IRS explains Generally the custodial parent is the parent with whom the child lived for a longer period of time during the year. Who Claims the Child if Both Parents Have Similar Incomes.

Only one person can claim your child on their yearly tax return. Whoever has custody for the greater part of the year as often stipulated in the divorce settlement typically gets to claim the child unless the court rules otherwise. Who claims child on taxes with 5050 custody texas.

To claim the child care tax credit the child must spend more than 50 of their time with you. So the parent with the higher adjusted gross income gets to claim the child as a dependent on their taxes even if they spend zero days per tax year with them.

50 50 Possession Schedule In Texas Sisemore Law Firm P C

Full Custody In Texas How To File And Win Custody Of Your Children Houston Divorce Lawyers The Larson Law Office

Child Custody In Texas Who Can Claim A Child On Their Taxes

50 50 Custody In Texas Cook Cook Law Firm Pllc

5 2 2 5 Parenting Schedule Joint Physical Custody Williams Divorce

Who Claims A Child On Taxes In A 50 50 Custody Arrangement

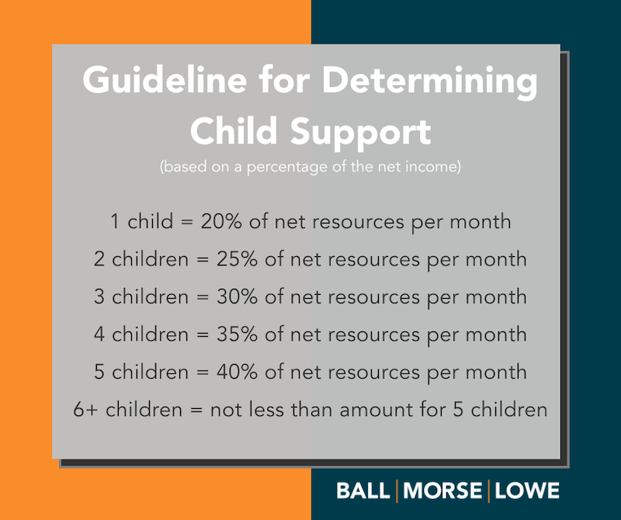

Calculate Child Support In Texas Reach Agreements On Child Support Mediation

50 50 Custody Arrangement In Texas Maynard Law Firm Pllc

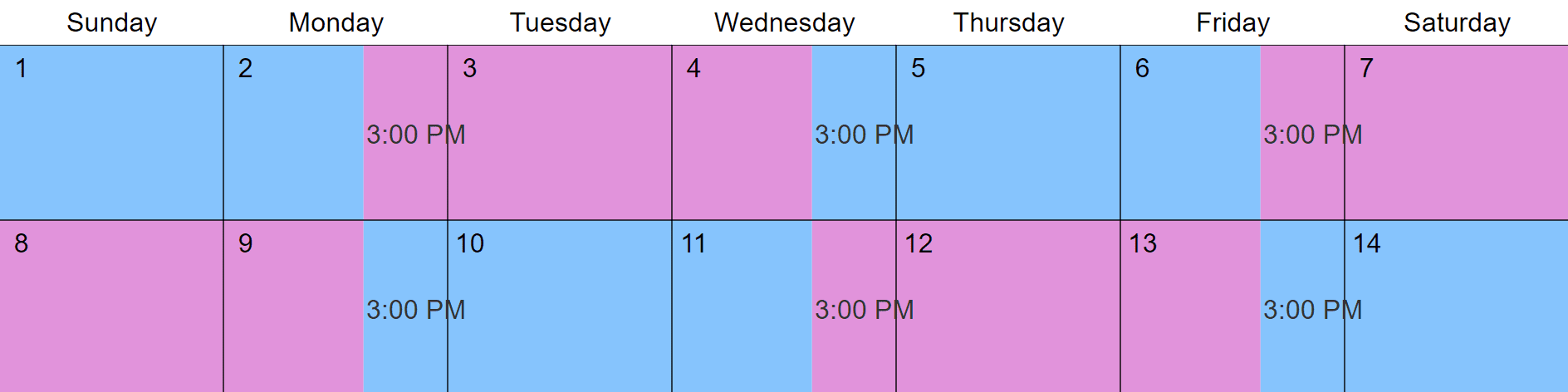

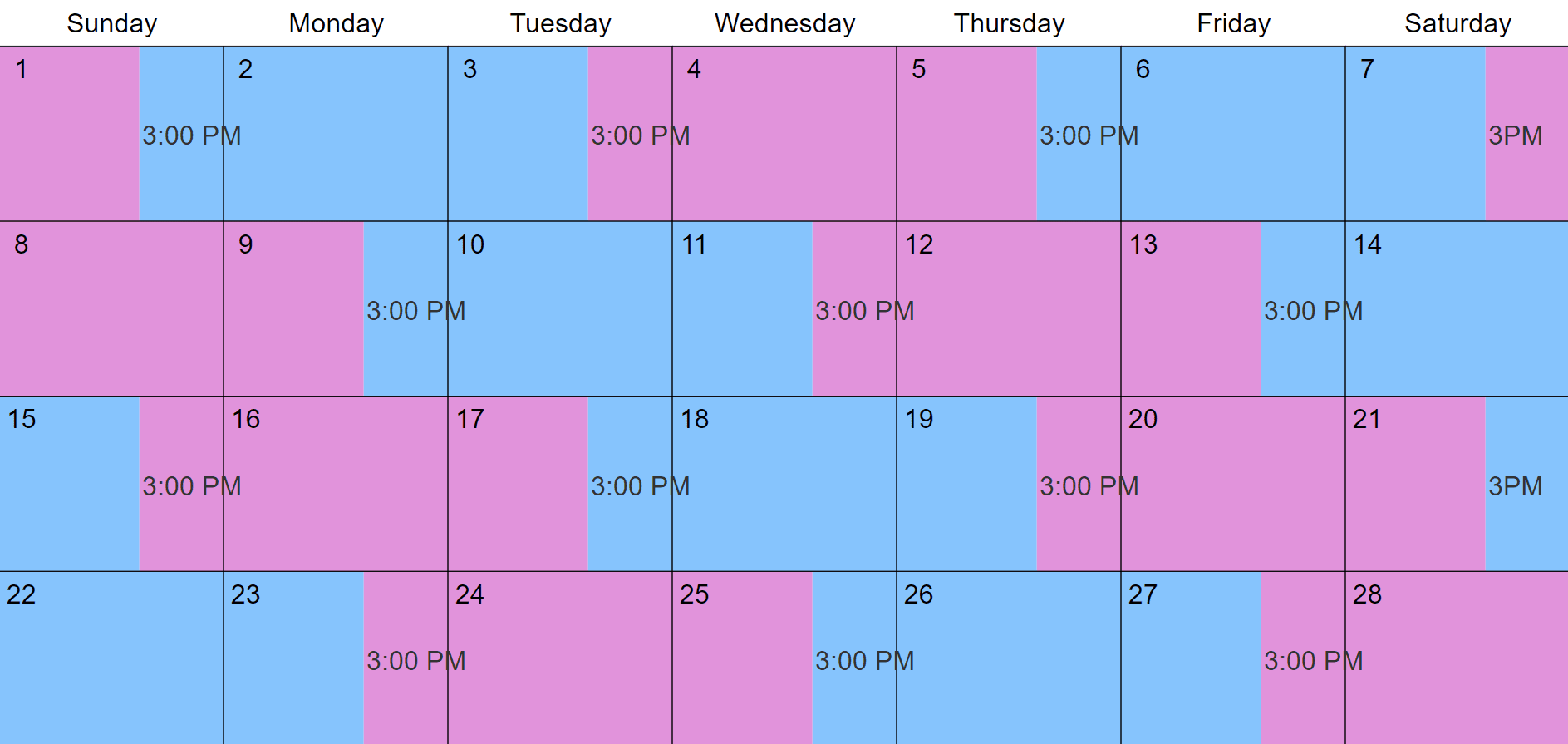

50 50 Child Custody Visitation Schedules Every 2 Days 2 2 3

50 50 Child Custody Visitation Schedules Every 2 Days 2 2 3

5050 Custody Child Support Online 60 Off Www Ingeniovirtual Com

50 50 Custody How Do I Get 50 50 Custody In Texas

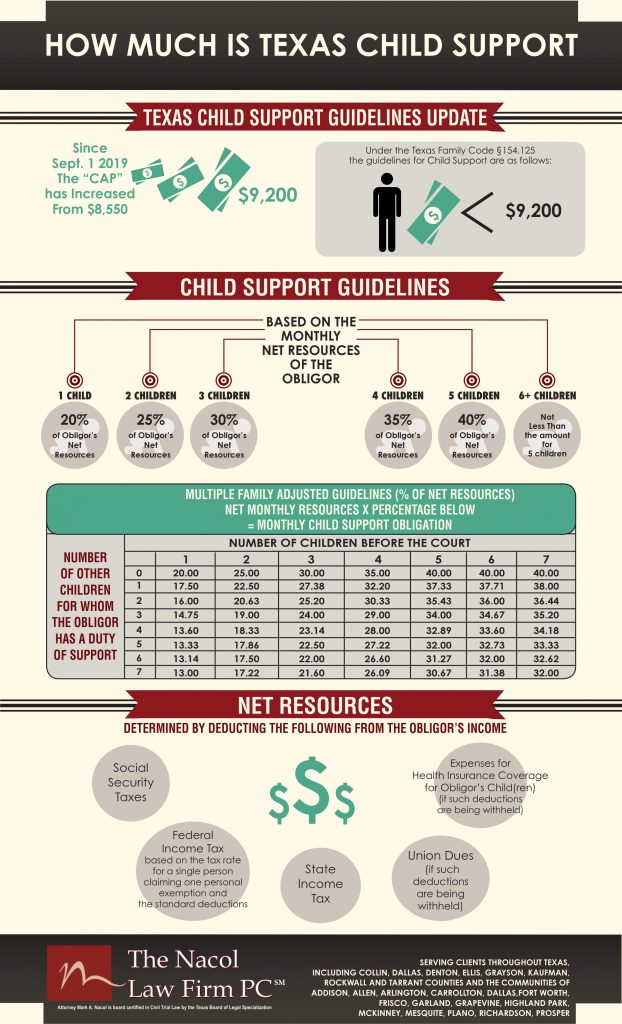

Child Support In Texas How It Works

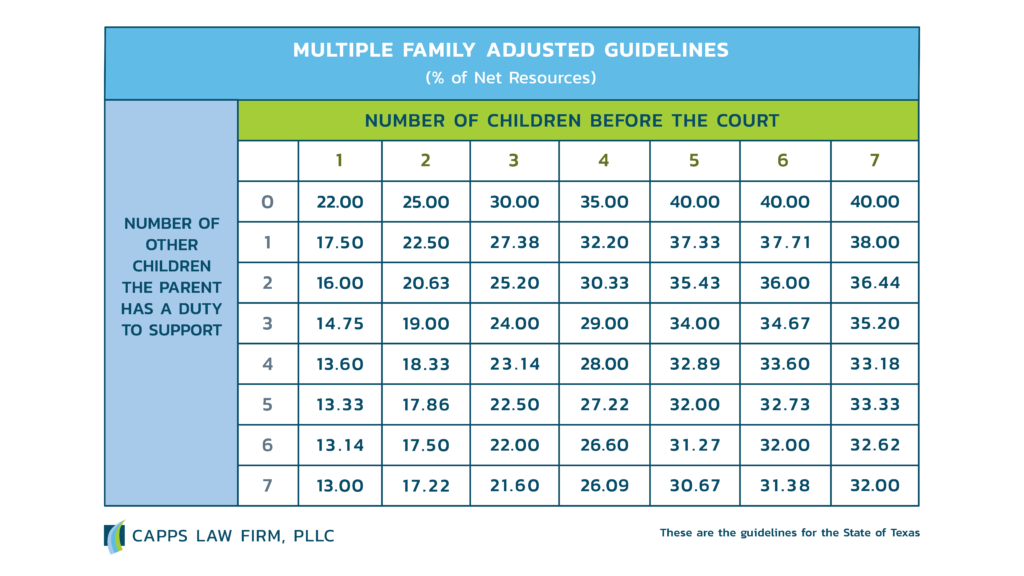

Child Support In Texas With 50 50 Possession Capps Law Firm Austin Family Lawyer

How To Create A 50 50 Custody Split With Your Ex Spouse In Texas

Texas Child Support Fathers Rights Dallas

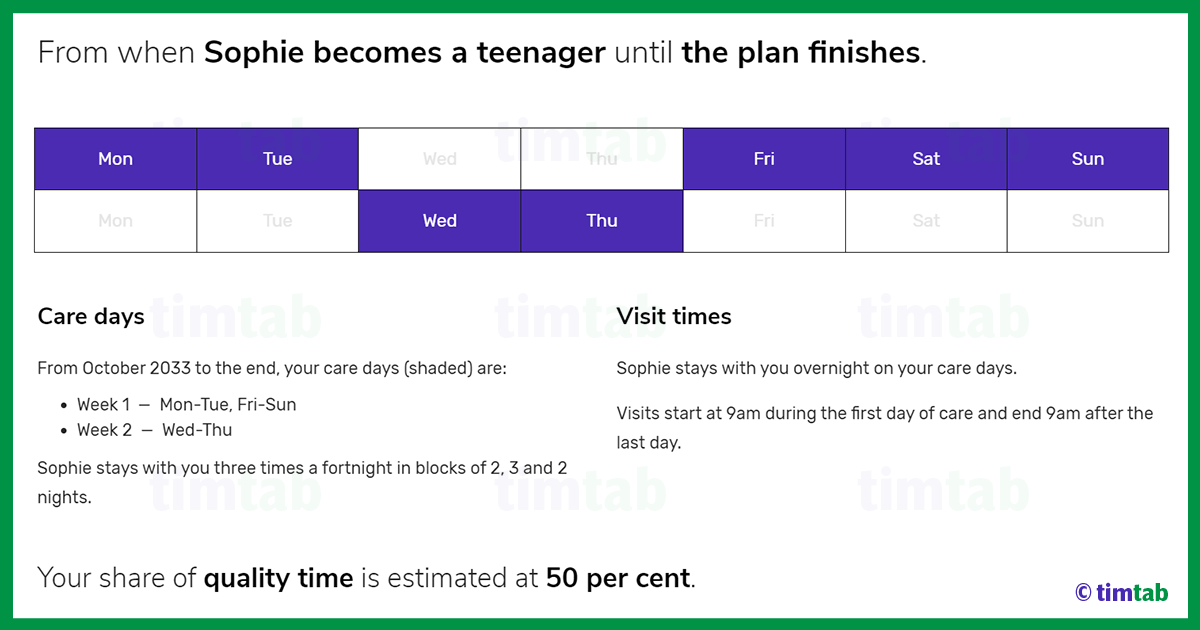

50 50 Shared Parenting What Does This Look Like Ourfamilywizard

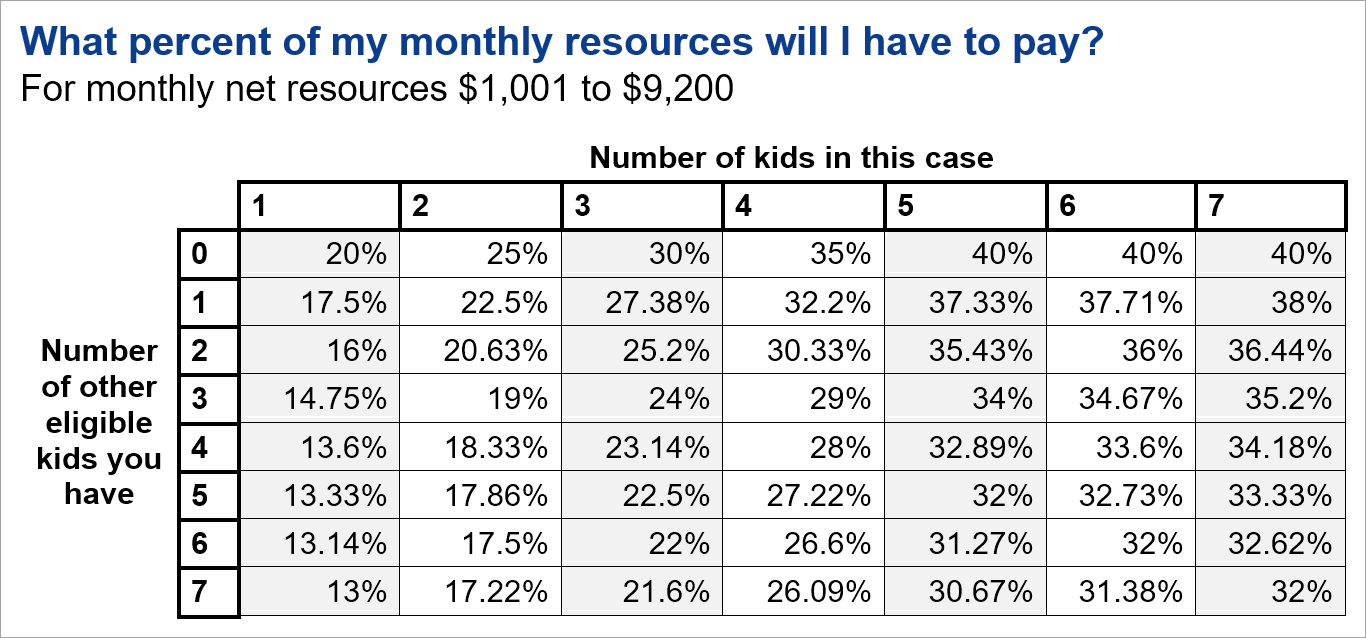

The Easiest Texas Child Support Calculator Instant Live

5050 Custody Child Support Online 60 Off Www Ingeniovirtual Com